|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Buying Programs: Essential Insights and Strategies for Future HomeownersPurchasing a home is a significant milestone and a major financial decision. Fortunately, various home buying programs are designed to assist potential homeowners in making their dreams a reality. These programs offer numerous benefits, including financial assistance, educational resources, and favorable loan terms. Understanding Home Buying ProgramsHome buying programs are initiatives often sponsored by federal, state, or local governments, as well as private organizations. They aim to make homeownership more accessible, especially for first-time buyers, low-income families, and veterans. Types of Home Buying Programs

Key Benefits of Home Buying ProgramsHome buying programs offer several advantages to eligible buyers. These include:

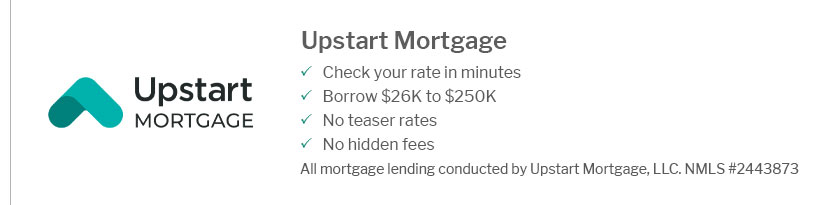

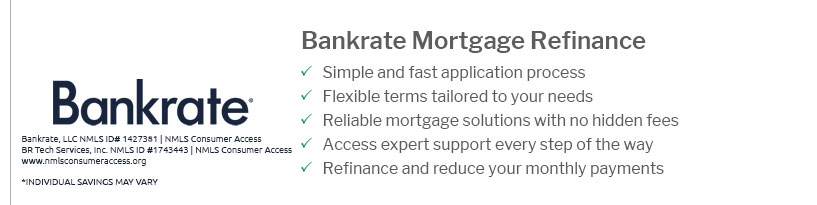

Exploring Financial Assistance OptionsFinancial assistance is a cornerstone of many home buying programs. For those interested in refinancing options, it's beneficial to explore todays refinance mortgage rates to understand current market conditions and make informed decisions. Maximizing the Benefits of Home Buying ProgramsTo fully benefit from home buying programs, potential homeowners should:

Additionally, considering options like low closing cost refinance mortgage can help reduce expenses associated with buying a home. Frequently Asked QuestionsWhat is a first-time homebuyer program?A first-time homebuyer program is designed to help individuals purchasing their first home with benefits such as down payment assistance, lower interest rates, and sometimes tax credits. How can I find out if I qualify for a VA loan?To qualify for a VA loan, you must be a veteran, active-duty service member, or an eligible family member. You can check your eligibility by obtaining a Certificate of Eligibility from the Department of Veterans Affairs. Are there programs available for non-first-time homebuyers?Yes, there are programs for non-first-time homebuyers, such as FHA loans, which offer favorable terms for those who do not qualify as first-time buyers but may still benefit from financial assistance. https://www.calhfa.ca.gov/homebuyer/programs/myhome.htm

MyHome Assistance Program - CalHFA Government Loans (FHA): MyHome offers a deferred-payment junior loan of an amount up to the lesser of 3.5% of the purchase ... https://www.sf.gov/resource--2022--apply-homebuyer-programs

Apply for homebuyer programs. If you are thinking of buying a home for the first time, MOHCD has programs that can help you. https://www.sf.gov/information--mohcd-homebuyer-programs

Under all three programs, the homeowner must notify the City when reselling the home.

|

|---|